Loan Protection

Purchase Protection

RMCU partners with TruStage to offer affordable life, auto, and property insurance options. In addition to getting a loan with RMCU, protect your hard-earned purchase with insurance.

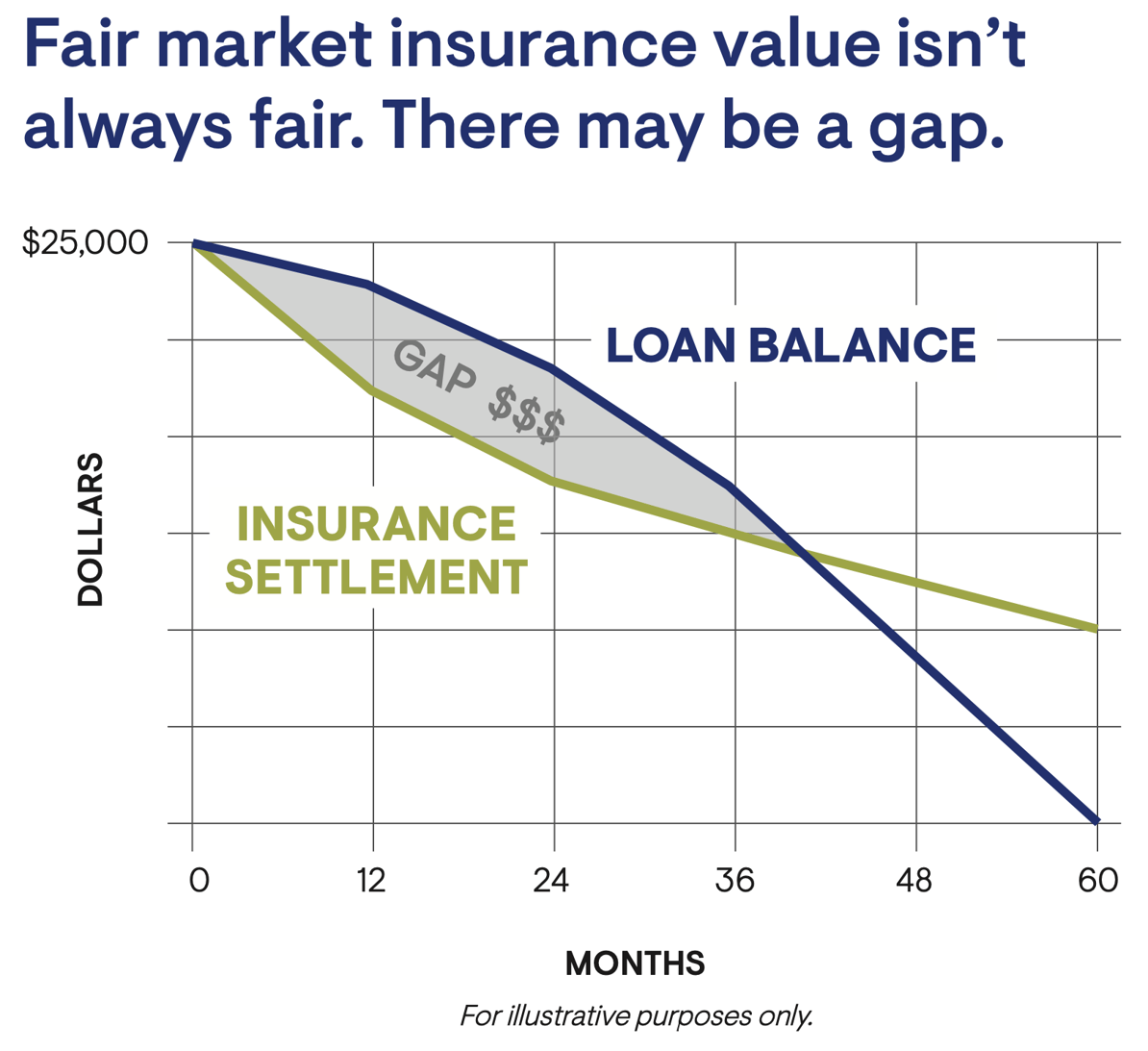

GAP & GAP Plus

Optional protection for your vehicle loan – and your finances.

GAP: May reduce or even eliminate the shortfall between what your vehicle insurance will cover and what you owe on your loan if your vehicle is deemed a total loss.

GAP Plus: It can help reduce your next loan at the credit union, making getting the replacement vehicle you’ll need easier.

Optional financial protection on your vehicle loan that helps you drive with confidence. Talk to RMCU today about how we can help protect you from sudden out-of-pocket expenses with GAP.

GAP is not insurance; it is an optional debt cancellation product. GAP will not affect your application for credit or the terms of any credit agreement you have with us. Specific eligibility requirements, conditions, and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP Fee to the amount financed under your contract will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days, you will receive a full refund of any fee paid.

© TruStage

GAP-3415672.3-0124-0226

Mechanical Repair Coverage

Optional protection against unexpected repair costs.

Mechanical Repair Coverage may help limit unexpected, covered repair costs as your vehicle ages, potentially saving your budget from future unexpected repair costs. Moreover, it can be used at any authorized repair facility in the continental United States of America, Alaska, Hawaii, and Canada.

With Mechanical Repair Coverage, you can enjoy many valuable benefits, among which are:

- Substitute transportation: up to $50 per day for a maximum of 10 days, available on the first day of coverage. Options for traditional rental cars or ridesharing are available.

- 24-emergency roadside assistance: up to $125 per occurrence, includes towing, battery jumpstart, fluid delivery, flat tire assistance, lock-out service, and extracting your vehicle from an inaccessible area within 50 feet of a paved road or highway.

- There is no out-of-pocket expense (except for any deductible): the administrator pays the repair facility directly for the covered repair.

Learn more in the TruStage Mechanical Repair Coverage brochure.

Help protect yourself from unexpected, costly covered repairs by talking to RMCU to find out what Mechanical Repair Coverage plan is right for you.

Mechanical Repair Coverage is provided and administered by Consumer Program Administrators, Inc. CUNA Mutual Insurance Agency, Inc. makes this coverage available to you. The purchase of Mechanical Repair Coverage is optional. This document provides general information about Mechanical Repair Coverage and should not be solely relied upon when purchasing coverage. Be sure to read the Vehicle Service Contract or the Insurance Policy, which will explain the exact terms, conditions, and exclusions. Coverage varies by state. Replacement parts may be new, used, non-OEM, or remanufactured.

© TruStage MRC-3415612.4-0324-0426

Loan Shield Debt Protection

Your financial safeguard against the unexpected.

Protect your loan payments against death, disability, or involuntary unemployment so you don’t have to compromise your financial health when the unexpected happens.

Loan Shield Debt Protection can cover your loan balance or payments up to the contract maximums. Purchasing protection is voluntary and won't affect your loan approval.

To purchase Loan Shield Debt Protection, contact your RMCU lender directly.

- No medical exam required to apply

- Customizable options for your needs and budget

- Premium is included in your loan payment

- Will not impact your loan terms or approval

Loan Shield Debt Protection is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Specific eligibility requirements, conditions, and exclusions may apply. Please contact your loan representative or refer to the contract for a full explanation of the terms. You will receive the contract before you are required to pay for Loan Shield Debt Protection. You may cancel the protection at any time. If you cancel protection within 30 days, you will receive a full refund of any fee paid.

© TruStage DP-3415586.2-1123-1225

Trustage Partnership

Rocky Mountain Credit Union partners with Trustage to offer the best in debt protection to our members.

Online Insurance Verification Portal

Need to provide your insurance for a loan?

Use one of the following methods to upload proof

- online: www.MyLoanInsurance.com/rmcu

- Fax to: 1-877-643-2042

- Email to: rmcu@myloaninsurance.com

- This is an automated email account, and only emails with file attachments in PDF, PNG, TIF, or JPG formats are accepted.

- Mail to:

Rocky Mountain Credit Union

Insurance Tracking Center

PO Box 924149

Fort Worth, TX 76124

Insurance Requirements

Your policy MUST include:

- Continuous insurance coverage with no lapses

- Rocky Mountain Credit Union was named as the lien holder or loss payee

- Comprehensive and collision coverage (or physical damage) with deductibles not greater than $1000

- No Excluded Drivers

PLEASE NOTE: An insurance ID card is NOT adequate evidence of the required physical damage insurance.

Have a question?

Call 1.888.396.9053

24-Hour Service